Welcome to Excel Avon

Why to use PMT Formula in Excel?

SUMMARY

In this post you can learn PMT Formula. PMT, one of the financial function. The PMT formula using for figure out the future payments for a loan, assuming constant payments & constant interest rate. This article contains many easy to follow PMT formula.

Formula

=PMT (rate, nper, pv, [fv], [type])

Arguments

rate – The interest rate for the loan.

nper -Total number of payments for the loan taken.

pv – total value of all loan payments now.

fv [optional ] – The future value. If fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0.

type [optional ] – The type of day count basis to use.

PMT Formula in Excel

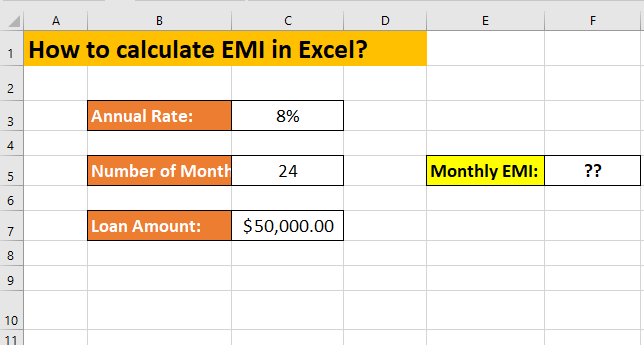

So to use the angel formula, we have created an example in which we will take a loan of 500000 and find its EMI. So now we will apply the formula and find the EMI. As you guys can see we have some data like Annual Rate, Number of Month, Loan Amount.

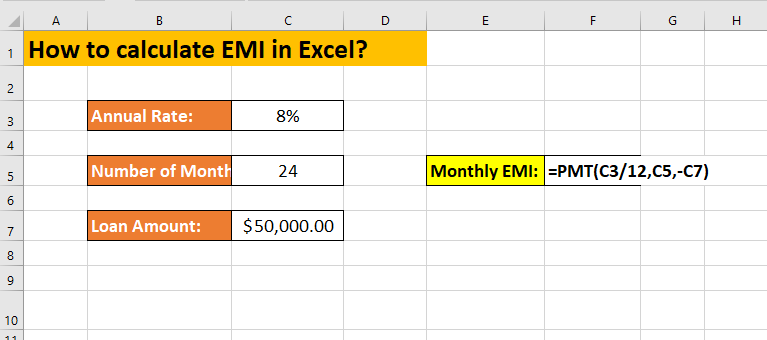

So now we will apply the formula.

=PMT(C3/12,C5,-C7)

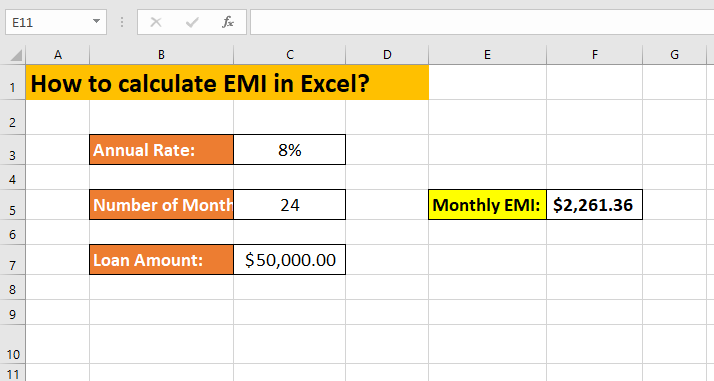

Monthly Monthly Calculated. Pay $2261.36 per month as EMI.

Notes –

-

The payment returned by PMT includes principal and interest but will not include any taxes, reserve payments, or fees.

-

If we wish to find out the total amount that was paid for the duration of the loan, we need to multiply the PMT as calculated by nper.

-

#VALUE! error – Occurs when any of the arguments provided are non-numeric.

-

#NUM! error – Occurs when:

-

The given rate value is less than or equal to -1.

-

The given nper value is equal to 0.

-

So I hope you have understood this formula and for more information you can follow us on Twitter, Instagram, LinkedIn and YouTube as well.

You can also see well explained video here